Investing in the Future: Top 5 REITs to Watch for the Next Decade

BlogTable of Contents

- Top 10 Reits 2024 - Jamima Selina

- The Best REIT ETFs of 2024 - Buy Side from WSJ

- The Best 3 REITS to BUY in 2024 for Dividend Growth Investors - YouTube

- Top Reits For 2025 - Debra Eugenie

- Top Reits For 2025 - Ariana Bianca

- 10 Top REITs To Buy In 2024 | Seeking Alpha

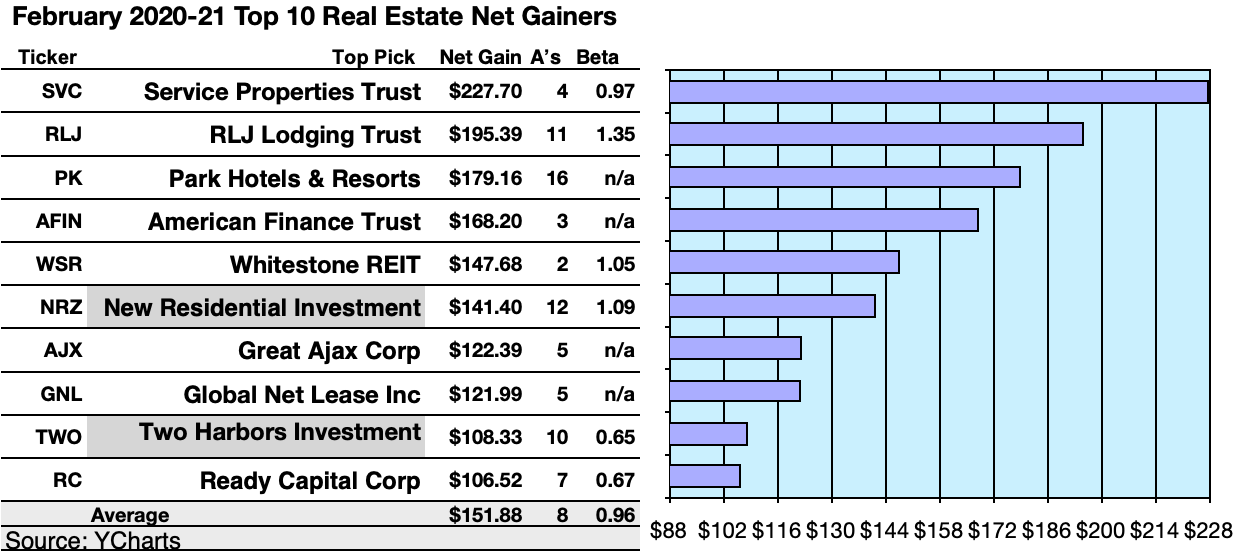

- Top REITs for March 2021

- Top REITs for Yield Seekers - YouTube

- REIT: A pathbreaking trend that boost the FOP in real estate in 2024 ...

- The State of REITs: December 2024 Edition | 2nd Market Capital Advisory ...

What are REITs?

Top 5 REITs to Buy for the Next Decade

:max_bytes(150000):strip_icc()/GettyImages-960287192-28108b63c00941988a6890e321c2c1e2.jpg)

- Realty Income (O): Known as "The Monthly Dividend Company," Realty Income has a proven track record of delivering consistent income to shareholders. With a diverse portfolio of commercial properties, Realty Income is well-positioned for long-term success.

- National Retail Properties (NNN): As a leading owner of retail properties, National Retail Properties boasts a strong portfolio of tenants and a history of steady dividend payments. With a focus on convenience stores, restaurants, and other essential businesses, NNN is a solid choice for investors.

- Simon Property Group (SPG): As one of the largest shopping mall REITs in the US, Simon Property Group has a significant presence in the retail landscape. With a strong balance sheet and a history of adapting to changing consumer trends, SPG is a top pick for investors.

- Welltower (WELL): With a focus on healthcare and senior housing, Welltower is poised to benefit from the growing demand for these services. This REIT has a strong track record of delivering solid returns and is well-positioned for long-term growth.

- Mid-America Apartment Communities (MAA): As a leading owner of apartment communities, Mid-America Apartment Communities offers a unique blend of growth and income potential. With a strong presence in the US apartment market, MAA is a solid choice for investors seeking a stable and growing income stream.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. It's always important to do your own research and consult with a financial advisor before making any investment decisions.